2022 International Student Tax Filing

U.S. tax laws can be complex and confusing. We all get headaches during tax season. The laws that apply to international students are not the same as those that apply to U.S. citizens. These resources should help you to better understand your tax obligation, to learn what and where to research, and to successfully submit your tax forms. This page is meant to be a general introduction. The staff and faculty at CSB+SJU are not tax professionals, so this cannot be considered legal tax advice. You are advised to review the information from the IRS specifically addressed to foreign students and scholars.

Overview: Taxes and the IRS

The Internal Revenue Service (IRS) is the U.S. government agency that collects taxes. As a nonresident F-1 or J-1 student, you may need to file forms each year with the IRS, even if you earned no income. It is your individual responsibility to understand and meet your tax obligations. Tax returns are due by April 18, 2023.

While employers do withhold money from your paycheck throughout the year and send it to the IRS, it may not equal the exact amount owed at the end of the year. If too much was withheld, you may be eligible for a refund. The only way to get this money returned to you is to file an income tax return. Otherwise, the Federal government will keep your refund. They will not send you a reminder!

Or, perhaps not enough was withheld, and you will owe more. In this case, you will need to pay the additional amount.

Salary from a job is not the only kind of earning taxed; many types of income are taxable, such as scholarships, fellowships, and childcare. That is why it is important to file your taxes annually. Even if you did not work and do not owe any taxes, you may need to submit an informational form to the IRS.

Who Must File Tax Forms?

Every international student (F and J status) has an obligation to complete a tax form once per year for the first five calendar years that you are in the US.

CSB+SJU have purchased a tax software program called Glacier Tax Prep (GTP). GTP will count how many days you have been in the U.S. and determine if you are a resident or nonresident for tax purposes.

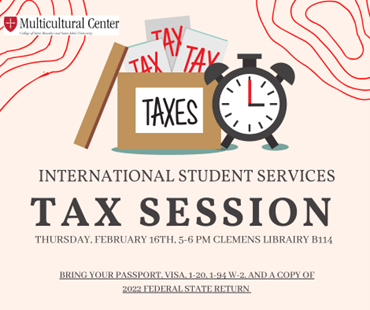

Our first tax prep session will be on Feb 16, 2023 (see flyer):

We will continue to allow access to Glacier Tax Prep until all the access codes have been used. The access code will be sent out by email in Feb, 2023. We will send out information about the Tax session at the beginning of March.

Resident or Nonresident for Tax Purposes

In legal terms, non-citizens of the U.S. are called “aliens.” There are three types of aliens for tax purposes: (1) nonresident; (2) dual-status; and (3) resident. These categories are for tax purposes only and are not related to your immigration status.

Substantial Presence

You may be in F-1 or J-1 non-immigrant status and considered a resident for tax purposes.

Nonresident aliens generally meet the substantial presence test if they have spent more than 183 days in the U.S. within the last three years. Having substantial presence in the U.S. generally means you will be considered a resident alien for tax purposes. Glacier Tax Prep will help you make this determination.

Important Concepts

Tax Treaties

The U.S. has income tax treaties with many different countries. Residents of these countries may be taxed at a reduced rate or be exempt from U.S. income tax withholding on specific kinds of U.S. source income. Treaties vary among countries. If the treaty does not cover a particular kind of income, or if there is no treaty between your country and the U.S., you must pay tax on the income in the same way and at the same rates shown in the instructions for Form 1040NR. Glacier Tax Prep will tell you if you may claim tax treaty benefits.

Taxable Income

Some kinds of income are taxed while others are not. For students and scholars who are considered nonresidents for tax purposes, interest income is not taxed if it comes from a U.S. bank, a U.S. savings and loan institution, a U.S. credit union, or a U.S. insurance company. Generally, income from foreign sources is not taxed. Wages that appear on form W-2 are taxable. Scholarship or fellowship income that requires services (i.e. teaching or research assistant) will be treated as wages (like employment). Scholarships, fellowships, and grants may be partially taxed. For degree-seeking students, portions used for tuition, fees, books, supplies, and required equipment are not taxed; portions used for other expenses, like room, board (meals), and travel, are taxable.

Social Security and Medicare

Nonresident students and scholars on F-1 and J-1 visas, who are also considered nonresidents for tax purposes, should not have Social Security or Medicare taxes withheld from pay. If these taxes have been withheld, contact your employer for reimbursement. If you cannot get a refund from your employer, use Form 843 Claim for Refund and Request for Abatement to request a refund from the IRS. Glacier Tax Prep will help you with this process.

Resident for Tax Purposes

If you have determined, based on the substantial presence test or marriage to a U.S. citizen or resident alien, that you are considered a resident for tax purposes, then you will generally have the same federal income tax requirements as a U.S. citizen. Please note that in this context, the term “resident” applies only to your tax requirements and is not related to your immigration status. Review Publication 17: Your Federal Income Tax Guide.

Filing Tips

- Make photocopies of your documents for your records.

- Be careful to complete the correct form; it is easy to mix up 1040NR with the 1040, for instance.

- Sign and date all forms and be sure to mail them before the stated deadline.

- Start the process using GLACIER Tax Prep; it should work for all students or scholars who are nonresidents for tax purposes.

Identity Theft & Scams

Please be careful of fraudulent scams and internet “phishing” that use the IRS name or other tax-related references to gain access to your personal information in order to commit identity theft.

Scam Examples

- Suspicious emails which claim to be from the IRS and offer a tax refund. The email requests your Social Security Number and other personal information in order to process the refund.

- Fake IRS correspondence and an altered Form W-8BEN, “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding” are sent to nonresident aliens who have invested in U.S. property and have U.S. source income. The false form asks for personal and financial information which is not normally collected on the W-8BEN.

These are just two examples of many possible types of scams. Do not respond to such emails or contacts. The IRS does not send unsolicited emails or request personal information by email. It also does not request PIN numbers, passwords, or similar secret access information to individuals’ credit cards, banks or other financial accounts. You can learn more about scams on the IRS website and report phishing scams to the IRS.

Before You File: Documents to Save

Before you begin the filing process, be sure you have all the necessary information with you.

- Form W-2 Wage and Tax Statement: W-2 forms are mailed to current and former employees. This form shows how much you earned last year and how much was taken out for taxes. You will only receive this form if you have been employed. Many employers allow you to print your W-2 online.

- Form 1042-S: The 1042-S form will only be given to nonresident alien students who have received scholarship or fellowship money that exceeds tuition and related fee charges. You will not receive a copy of the 1042-S form if you only have a tuition waiver on your account and do not receive any checks. If you expect to receive a 1042-S form, wait until it is issued before filing your tax return.

- Form 1099 (if applicable): The 1099 form documents miscellaneous income. For example, if you had CPT authorization to work as an independent contractor, rather than as an employee of an organization, you might receive Form 1099 instead of Form W-2 to document your earnings.

- Passport

- I-20 (F-1 status)

- DS-2019 (J-1 status)

- Social Security Number or Individual Tax Identification Number (not required if you will file only Form 8843)

- Address information (current U.S. address and foreign address)

- U.S. entry and exit dates for current and past visits to the U.S. You can get much of your travel information from the online I-94 system: https://i94.cbp.dhs.gov/I94/

- Academic institution or host sponsor information (name, address, phone)

- Scholarship/fellowship grant letter (if any)

- A copy of last year’s federal income tax return, if filed

How to File: Glacier Tax Prep

To help make tax filing easier for F-1 and J-1 non-immigrants, ISS provides free access to Glacier Tax Prep.

- This web-based program, GLACIER Tax Prep, provides step-by-step instructions and assistance with the preparation of the appropriate forms.

- Students may use Glacier Tax Prep at no charge, but you must receive the access code through your CSB+SJU email.

- GLACIER Tax Prep (“GTP”) is a tax return preparation software program designed primarily for Nonresident Alien students, scholars, trainees, researchers, and other educational immigration statuses to prepare a U.S. federal income tax return.

- GTP is provided to you for your convenience. You are not required to use GTP to prepare your U.S. federal income tax return. CSB+SJU does not provide tax advice and therefore disclaims all liability from the misinterpretation or misuse of GTP.

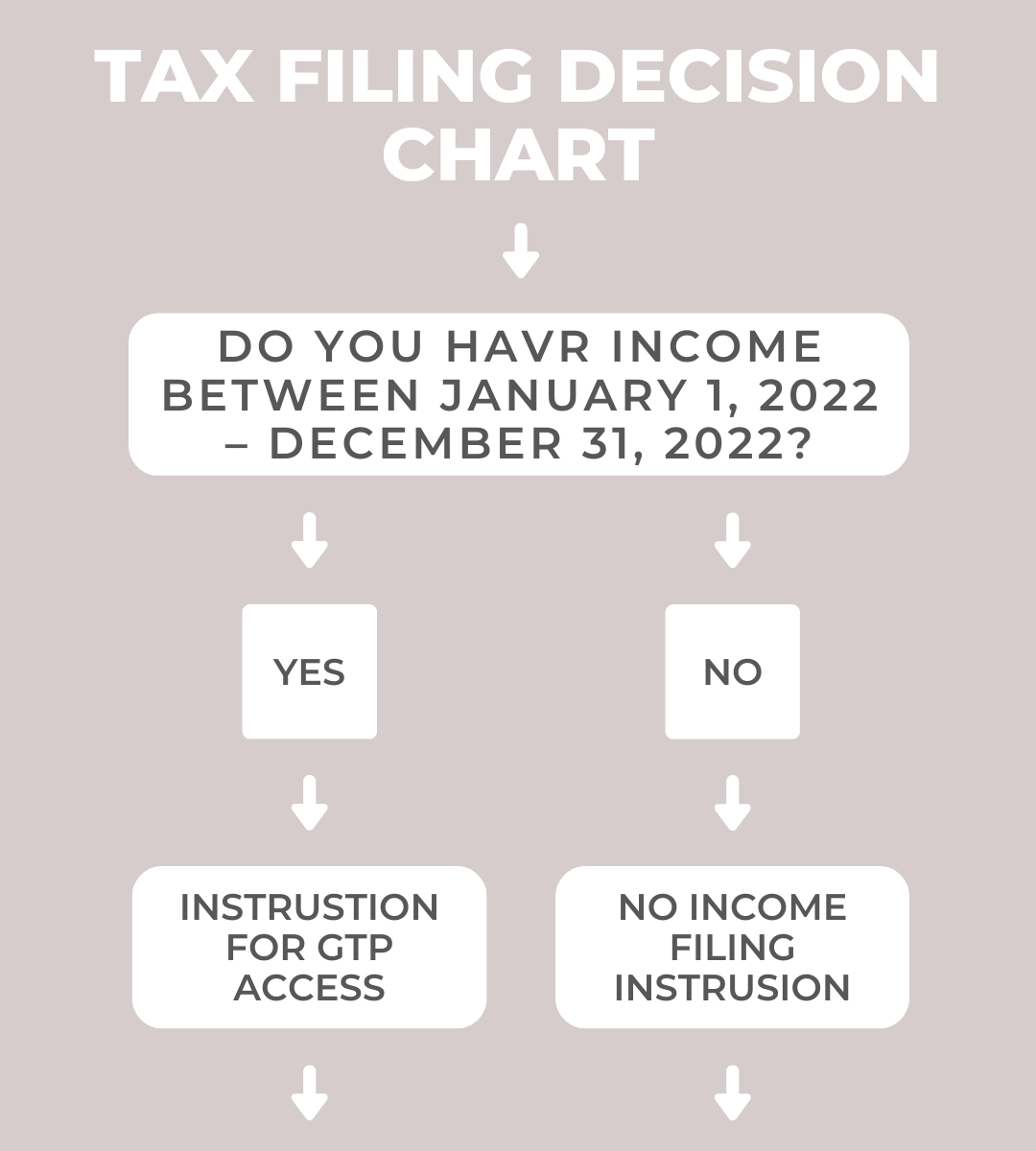

No-income filing and Access of Glacier Tax Prep